Have you ever been at a social gathering where the conversation inevitably turns to stock market triumphs and (often exaggerated) tales of missed opportunities? These casual exchanges often highlight a crucial truth: most investors chase the next big thing, neglecting the importance of a well-defined, long-term strategy.

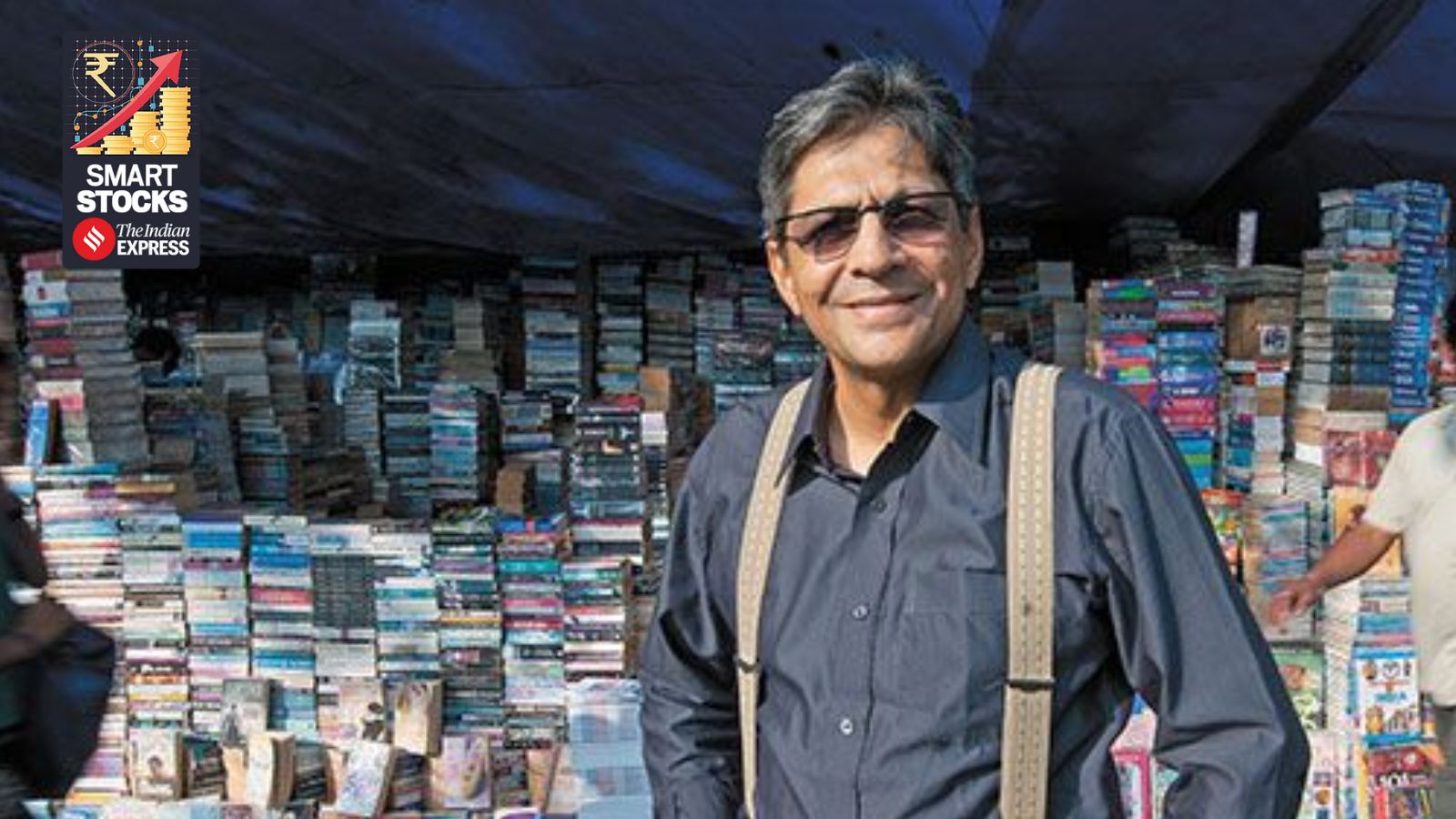

Seasoned investors like Warren Buffett and Rakesh Jhunjhunwala understand something many don't: investor behavior is as crucial as stock selection. This is a lesson Parag Parikh learned firsthand, transforming his observations into a powerful investment philosophy that underpins PPFAS's approach.

Parag Parikh's decades of experience, honed through observing diverse investors, yielded five key behavioral insights:

Parag Parikh's insightful observations transformed into a robust investment philosophy emphasizing quality, patience, and clarity. PPFAS's ongoing success demonstrates the enduring value of this approach. This isn't about promoting a fund, but about highlighting the power of thoughtful decision-making, staying committed to sound businesses, and trusting the power of time in building wealth. Investing can be steadier and more rewarding when these principles are applied.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Consult with a qualified financial advisor before making any investment decisions.

Parth Parikh is the author of this article.